Today, gender equality is essential because, over the years, it has been found that men and women are both needed for the running of a successful and progressive society. While substantial strides have been made toward bridging the gender gap, some subtle yet significant inequalities persist, one of which is the infamous “Pink Tax.”

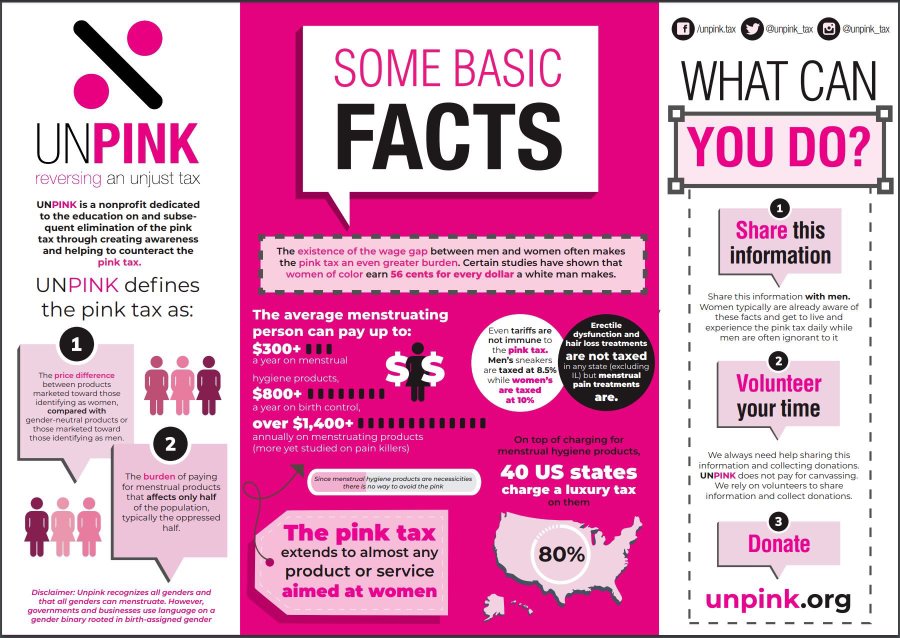

What is the Pink Tax? The pink tax refers to the phenomenon where products and services marketed specifically toward women are more expensive than those marketed toward men. This phenomenon is often attributed to gender-based price discrimination, which means that women pay more for everyday items such as personal care products, clothes, toys, and even financial services. However, research shows that the primary cause is women sorting into goods with higher marginal costs. The name “Pink Tax” comes from the traditional association of the colour pink with femininity and its symbolism in gender stereotypes.

The Pink Tax can be traced back to the early 1990s in the United States when consumer advocates and researchers began to notice the discrepancy in prices between gender-segregated products. The New York City Department of Consumer Affairs conducted one of the first comprehensive studies on gender-based pricing in 1995. Their research revealed that women paid significantly more for nearly identical products than men, an average of around 7% more. This included items like razors, deodorants, and haircuts. In the toy sector, girls’ toys cost on average 7% more than boys’ toys. The study showed a side-by-side comparison of a Radio Flyer scooter where the red scooter costs $24.99 and a pink scooter, identical in all ways but colour, costs $49. In children’s apparel, girls’ clothes were 4% more expensive than boys’. Women’s clothing was 8% more expensive than men’s clothing. The largest discrepancy came to personal care and hygiene products, where women’s products cost 13% more than men’s. The researchers found that manufacturers and retailers justified the higher prices for women’s products, citing factors like higher production costs or special features. However, these justifications did not always align with the actual price differences. This raised concerns about a potential pattern of systematic gender discrimination.

Over the years, the Pink Tax debate gained momentum, attracting attention from activists, lawmakers, and media outlets worldwide. Consumer groups pushed for transparency and pricing equality, urging companies to end this discriminatory pricing practice. Despite increased awareness, progress remained slow.

The Pink Tax is not confined to any one country or region. Its impact is felt across the world, perpetuating gender inequality and affecting women’s purchasing power. According to a 2018 study conducted by the European Parliament, women in Europe were found to spend about 7% more on everyday products compared to men. This extra cost amounted to an average of €1,370 per year per person.

In the UK, women and girls were being charged on average 37% more for toys, cosmetics, and clothes than their male counterparts. The UK also faces the Pink Tax on school uniforms. Girls’ school uniforms are 12% more expensive than boys’ uniforms. This goes for both primary and secondary school-age children. In recent times Argentina women pay 12% more than men for the same products. In 2021 the gap was at 11% and went up the following year in 2022.

In the United States, a study by the New York City Department of Consumer Affairs in 2015 found that women paid approximately 7% more than men for similar products. Another study by the University of Central Florida in 2018 revealed that, on average, products targeted at women cost 13% more than similar products marketed to men.

A study by the Times of India in 2018 found that products marketed to women were priced up to 50% higher than equivalent products for men. This disparity encompassed personal care items, clothing, and toys. Japan, known for its traditional gender roles, is not immune to the Pink Tax. A study conducted by Osaka City in 2018 revealed that women’s products were priced around 24% higher than men’s products. In South Korea, a survey by the Korean Women’s Development Institute in 2019 found that women’s personal care products were priced 11% higher than men’s. According to a 2017 study by the Ministry of Commerce, women’s clothing and personal care products in China were priced 17% higher than men’s. In Singapore, a check by The Sunday Times on ten companies found that women pay more for some products and services, like dry cleaning and razors, offered by about half of these companies. Additionally, women in Singapore have to pay more premiums for Careshield Life, a national long-term care insurance scheme introduced by the government.

There are many reasons why the pink tax exists, including tariffs, product discrimination, and product differentiation. There are many suggested causes of this discrepancy, including price elasticity and the belief that women are more prepared than men to pay higher prices for their purchases. Other reports suggest that marketing targets women to pay higher prices as ethical consumers. According to The Washington Post, women are more likely to spend more money on improving their appearance, because not doing so is associated with the risk of losing revenue. Some studies showed that attractive people tend to earn higher salaries, receive higher grades in school, receive shorter prison sentences, and are more likely to be hired and promoted in the workplace. This factor is not relevant for men.

Some people argue that product differentiation can account for a portion of the difference between the prices of men’s goods and women’s goods. For example, a pink scooter may cost more than a red scooter because it is more expensive to paint a scooter pink than red, assuming such a large difference for this reason of production would be because the red scooters are the larger production, and pink scooters are in the minority. However, there has never been any evidence presented, for example, that pink paint costs more than red paint or blue paint, thereby creating cost differentials in colour-coded items geared toward different genders. The Pink Tax also arises in services like haircuts or dry cleaning. Likewise, in dry cleaning, some people argue that men’s clothing tends to be more uniform while women’s clothing tends to have a lot of variabilities which can make it harder to clean. They also argue that pressing machines, normally made for men’s clothing, are more difficult to use on women’s clothes, which results in the dry-cleaners resorting to hand-pressing the clothing.

The reason those who campaign against the pink tax claim it to be so problematic is that higher prices for goods and services arise from gender alone, with no underlying economic justification such as higher costs of production in goods. Women’s and men’s razors are essentially the same, and distinguishing between them is simply a marketing strategy. People who have a greater need to buy a product are often willing to pay much more, leading to price discrimination. Women are often subjected to this in the tampon and sanitary napkin market creating a marginalised group among women who are “period poor”.

Criticism of the pink tax includes the principle that the idea robs women of agency and choice by suggesting that women are so easily brainwashed by marketing that they are prevented from choosing the lesser-priced but otherwise “identical” male-marketed alternative. Instead, critics have attributed the pricing disparity to market forces and stated that if women continue to buy a more expensive pink razor, it is because they see some utility or additional aesthetic that they are willing to pay for. Substantive differences in price may indicate differences in the marketability of different products. Critics argue that although seemingly identical products and services may be differently priced, the emotional experiences and perceived value are different.

A more recent study pointed out methodological flaws in the influential 2015 study from the New York City Department of Consumer Affairs. According to the study, the products considered in the report account for less than 6% of category sales and were not selected at random. While the sample was constructed by subjectively pairing men’s and women’s products, the study found that most pairs in the sample differ in their ingredients. They argue that a systematic analysis of the evidence reveals when comparing products made by the same company with the same leading ingredients, men’s products were more expensive in 3 out of 5 categories and that the findings do not support the existence of a systematic price premium for women’s products.

Activists and politicians argue that the economic impact of the pink tax is that women have less purchasing power, especially paired with the gender-based pay gap. Wage gaps and pension gaps already put women at a disadvantage when it comes to purchasing power. Women currently make a statistical average of 89 cents for every $1 a man earns in the United States, meaning women statistically, on average, have less income to spend on goods and services. This alone gives men more money and, ultimately, more buying power. The pink tax further contributes to the economic inequality between men and women. It is also argued that paying more for goods and services marketed to women while women earn less than men means men hold the majority of the purchasing power in the economy. Taxes on feminine hygiene products that men don’t need further contribute to this discrepancy. The Pink Tax’s impact extends beyond the financial burden on individual consumers. It reinforces harmful gender stereotypes and perpetuates the idea that women’s products and services are secondary or inferior. This discriminatory practice undermines gender equality efforts and restricts women’s economic empowerment.

Combatting the Pink Tax requires a multi-faceted approach involving consumers, policymakers, and businesses. There has to be an increase in awareness about the Pink Tax so that consumers are empowered to make informed choices and demand pricing transparency. Activists and policymakers should collaborate to introduce legislation that addresses gender-based pricing discrimination and ensures fair pricing practices. Companies should examine their pricing strategies and eliminate any unjustified price discrepancies between gender-segregated products.

The Pink Tax is a pervasive issue that demands attention and action from all segments of society. By understanding its origins and impact, we can work collectively to dismantle this discriminatory practice. Governments, businesses, and consumers must come together to challenge the status quo and build a more equitable future where gender-based pricing discrimination becomes a thing of the past. Empowering women economically should be a shared goal, and eradicating the Pink Tax is a significant step in that direction. Let us unite our voices to create a world where pricing is fair, just, and free from gender bias.